Or?

The ORPP or Ontario Retirement Pension Plan has been in the news a lot over the past few months. Is it a good thing? Does it help people in a way they don’t want to be helped? Or will the change in federal government mean it will be replaced by something else or disappear like a puff of smoke?

Let’s look

at the underlying reason for this plan. There

are fewer and fewer employers offering pensions, people are saving less

combined with the small amount of income people get from existing programs like

the CPP/QPP and OAS adds up to people not saving enough for retirement.

Or are

they? According to Malcolm

Hamilton of the C.D. Howe Institute in his paper, Do Canadians Save Too Little? , the assumptions and numbers used as a basis for the ORPP are

flawed and don’t address the “diversity of individual retirement goals”. His paper does make you question what we are

frequently told about savings and retirement.

What I take away from this paper is retirement goals are very personal

and what may be perfectly adequate income for one person may not be for

another. If you have an investment

advisor, have them do a financial plan for you to see if your goals and income

lineup.

For most of my working life, I have not had a pension and

it’s only been in the last few years my employer introduced a Group RRSP/DPSP

(Deferred Profit Sharing Plan) to supplement what I’ll get from the CPP (Canada

Pension Plan) and my own personal RRSP.

I’m so used to not having a pension, I’m not sure how I feel about being

forced into the ORPP where I don’t have the flexibility to do with the money what I

want like I have with an RRSP.

With the election of a Liberal

government that seems more open to piggybacking the changes Ontario wants on

top of the CPP, will the ORPP even be necessary?

Hicks Morley , in their paper, 2015 FEDERAL ELECTION UPDATE: ORPP OR CPP – WHICH WILL IT BE? thinks it will

take years to make changes to the CPP due to the time for the consultations and

agreement needed by both the federal government and 2/3 of the provinces for

any change. The years prediction sounds reasonable

since we can’t even get the provinces to drop tariffs on beer amongst each other. If

the Ontario government wants to keep their time line of starting to implement part

of the plan by January 1, 2017, they will need something tactical. It would be better if they just waited. It

will be expensive to set up a complete infrastructure to support this new plan

and then just throw it away if they go with a CPP solution long term or the continuing expense of operating it in parallel.

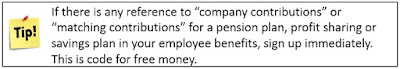

When the ORPP comes in, companies that have an existing pension

plan won’t see much change as long as they meet certain conditions

in order to be able to opt out of the ORPP. For example, for a Defined Contribution or DC

plan, where both employees and employers make contributions and the payout

comes from a combination of these contributions and the investment return, the

contributions must be 4% of base salary each or a total of 8%.

I have already heard companies are starting to adjust

their existing pension plans to meet the conditions or convert existing Group

RRSP/DPSP to pension plans. No word yet

from my employer on which direction they’ll be going, though if my DPSP is

converted to a pension plan, the current contribution level is not enough to

meet the conditions.

Small businesses aren’t too keen on the plan. This would be an additional payroll tax for

them and if you believe this article by the CFIB,

the unemployment rate will rise by 0.5% and wages will be reduced. I can’t vouch for the figures but it would

make sense for wages to be reduced or a decrease in raises for a number of

years until these taxes get absorbed.

Some employees may not be too keen as well for the additional payroll

deduction either if their expenses are already using up most of their income. Here’s a calculator

to give you an idea of how much you or an employer would be paying (e.g. if your income was

$40,000/year, you’d be paying an extra $693 in payroll deductions.)

The ORPP will help a lot of people not savings

enough for retirement but would have preferred it wasn’t a “one size fits all

solution” so it would target those most in need and that the Ontario government

waited to piggy-back on the CPP and save us all a lot of money. Now we just have to wait and see.

Here’s

a few additional links if you want to do some more reading.

What the experts think of the Ontario Retirement Pension Plan – The Star

Jack Mintz: Kill Ontario’s pension plan – Financial Post

Bill 56, Ontario Retirement Pension Plan Act, 2015

Ontario pensions and retirement savings – Ontario Government

ORPP: who is enrolled - Ontario Government

James Whelan

moneymatters4life@gmail.com